France is known for its strict regulatory provisions when it comes to medicines. The exception will not be made for the framework of relations between industries and health professionals, now known in France as the LEA. (anti-gift law)

So who is LEA?

Before, we used to say “anti-corruption law”, “DMOS”, “anti-gifts law”… These terms are no longer used. This system, which will soon celebrate its 30th anniversary (we are getting on in years), has just been revamped and we now speak of the “Benefits Framework System” or the “Benefits Framework Law” (the famous LEA in French) because it is a set of texts and a real arsenal put in place since October, 1st 2020 so that the State can better control relations between the health industries in particular, and health professionals in the broadest sense of the term. It should be remembered that it has to be considered in a very distinct way from the system of transparency of links, which pursues the objectives of publicising the advantages procured and agreements made in order to inform the general public and avoid any conflict of interest.

As we have just said, this system is not recent. It is true that over the years it has been considerably strengthened since it now concerns all health products, whether reimbursable or not, and its scope of application has gradually been extended to health professionals, students and their associations. But, in fine, its fundamental principle has remained the same: we are faced with a genuine “anti-corruption” mechanism applicable to relations between companies that market health products, such as medicines or medical devices, or provide health services, and health professionals (doctors, but also all other health professionals as well as osteopaths, chiropractors and psychotherapists). The aim is to ensure that HCPs are guided only by medical considerations in their choice of prescribing a product or health service and to prevent conflicts of interest.

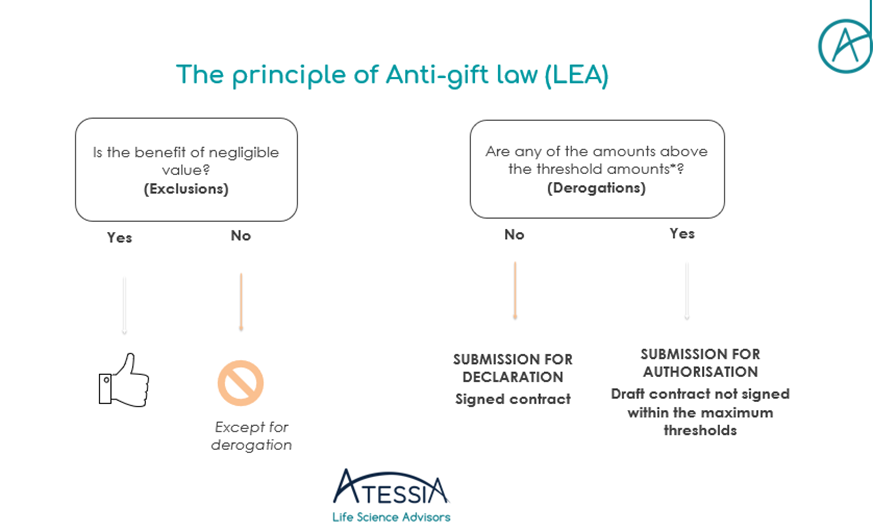

More concretely, the general principle is the following:

- Prohibition for companies to provide health services, producing or marketing health products to grant direct or indirect benefits, in kind or in cash; and

- Prohibition on health professionals, associations of health professionals and civil servants/public officials covered by the scheme from receiving such benefits.

It should be noted that these prohibitions are punishable under criminal law and that there is joint responsibility between the companies granting undue advantages and the beneficiaries of these advantages.

But let’s make it a little more complex… The LEA provides derogations from this principle of prohibition and subjects all authorised interactions (remuneration, hospitality in the context of professional, scientific or promotional events, participation in research activities, provision of services, sponsorship, donations) to prior control by the competent authorities, i.e. the medical professions’ council of order where they exist or the Regional Health Agency. However, one condition for the implementation of these derogations is the establishment of an agreement working as a contract which will then be submitted to the competent authorities. These derogations should not be confused with items excluded from the definition of a prohibited benefit, such as benefits in cash or in kind that relate to the exercise of the beneficiary’s profession and benefits of negligible value (e.g. impromptu meals, samples, books). It should be remembered that any benefit in excess of 10 euros must also be declared on https://www.transparence.sante.gouv.fr/ as part of the transparency of links.

Two submission regimes are possible: submission for declaration OR for authorisation.

To guide us in the choice of the applicable submission regime, threshold values have been published by decree. These values are then defined for each type of benefit provided. It now remains up to you to define the category in which your benefit falls…

If the benefits granted are below the thresholds, a declaration must be made 8 days before the benefit is granted, either on Idahe 2 or EPS. The benefit cannot be implemented before this deadline.

If the benefits granted are above the thresholds, an application for authorisation must be made at least two months before implementation. At the end of the two months, the competent authority will issue a binding decision, not an opinion.

To sum up :

Few innovations have been published since the new system was introduced on October 1st 2020, but the day-to-day implementation of the system raises a large number of questions of interpretation. ATESSIA can assist you in setting up and adapting your processes to comply with this system.

Article written by Floriane LUCY, Regulatory & Pharmacist Affairs Advisor